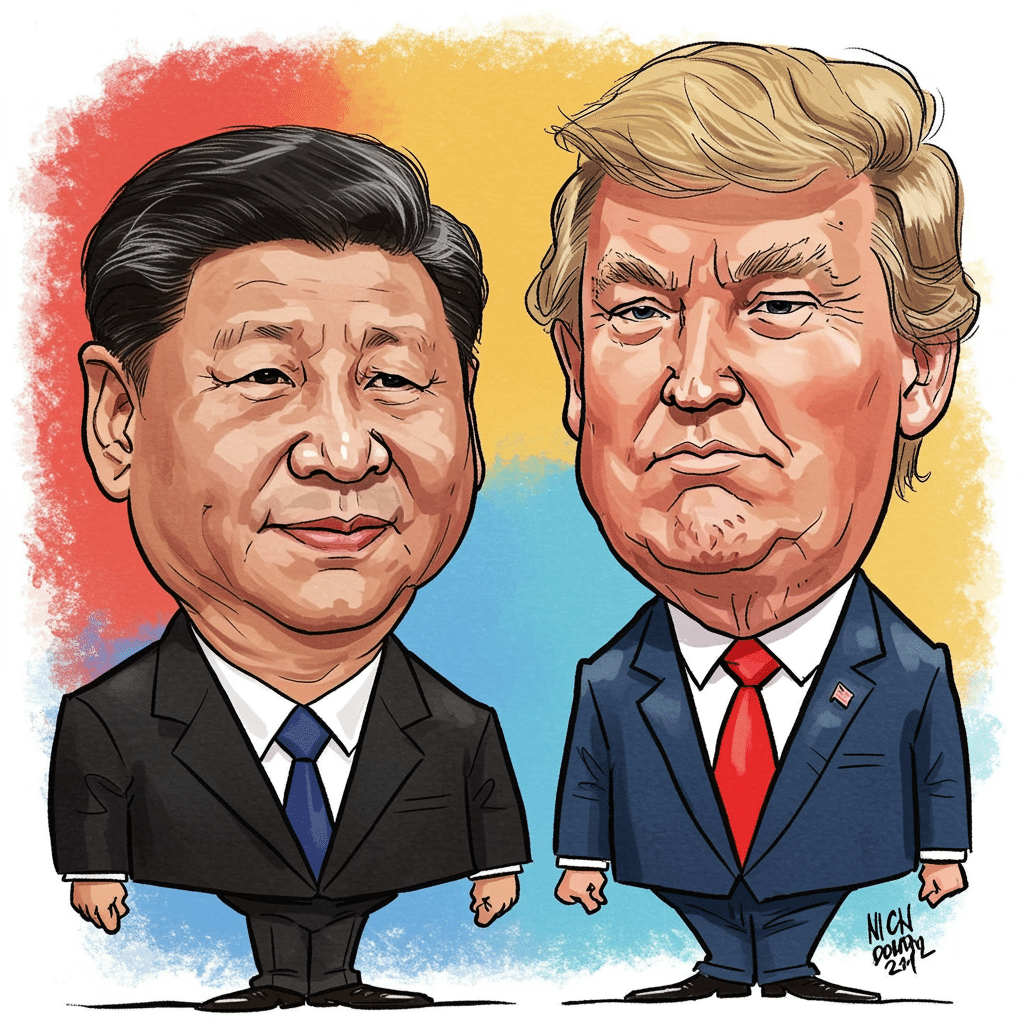

Lately, social media and some news outlets have been buzzing with two explosive claims:

- President Xi Jinping of China sold all Bitcoin (BTC) and crypto holdings

- Donald Trump is going to raise U.S. tariffs on China by 100%

If both were true, the combined effect could send shockwaves through global markets — especially crypto. In this article, we analyze whether there’s credibility behind those claims, examine the motivations, and forecast how the crypto ecosystem may respond.

Reacting to Rumors : Did China’s Xi Sell All BTC & Trump Announces 100% Tariff on China — Impact on Crypto Markets

1. The Claim: “Xi Sold All Bitcoin & Cryptos” — What’s the Basis?

Background & Evidence

- Over recent years, there has been speculation that China holds large amounts of crypto — not necessarily via official reserves, but from seizures tied to criminal cases (e.g. the PlusToken scam). Mitrade

- Some blockchain analysts have pointed out large Bitcoin transfers from addresses once associated with seized BTC, moving coins toward exchanges. These moves are sometimes interpreted as “sell” pressure. Mitrade

- However, no credible, verified source has confirmed that China (or Xi personally) has ever officially “sold all” of such holdings.

Assessment of the Claim

| Claim | Evidence / Weakness | Likelihood |

| — | — | — |

| Xi sold all BTC / crypto holdings secretly | Based mostly on speculative on-chain observations and lacks official confirmation | Low to Moderate |

| China ever held large BTC (e.g. seizures) | Supported by court rulings and seizure records (PlusToken) | Moderately High |

| China using mixers / exchange transfers to hide sales | Possible, as mixing and spread transfers are common in crypto obfuscation | Moderate |

So, while there may have been large movements or partial liquidation, the claim that “Xi sold everything” is likely exaggerated or misinterpreted.

2. The Claim: “Trump to Raise Tariffs 100% on China” — What’s Real?

This one has more grounding in recent news:

- President Trump has threatened to impose a 100% tariff on Chinese goods starting November 1 as retaliation for China’s export restrictions on rare earth minerals and other critical tech materials. Forbes+3AP News+3Reuters+3

- The U.S. also plans export controls on critical software to China. Reuters+1

- The markets reacted sharply: Bitcoin dropped, total crypto market cap fell, and liquidity crunches (mass liquidations) were reported shortly after the announcement. CryptoPotato+3The Block+3The Block+3

Thus, Trump’s tariff threat has more concrete basis, though whether it becomes a full 100% tariff depends on negotiation and political constraints.

3. How Would These Actions Affect Crypto & Markets?

Immediate Market Sentiment

- Volatility & Panic Selling: Market participants often react strongly to geopolitical and macro shocks; crypto is especially vulnerable to sentiment swings.

- Margin Liquidations: As seen already, hundreds of millions in positions have been liquidated due to sudden drops. CryptoPotato+1

- Correlation with Equity & Tech: Because many crypto investors also hold tech stocks or have exposure to global supply chains, negative sentiment in one affects the other.

Longer-Term Effects

- Capital Flight & Safe Havens: If trust in national currencies or markets weakens, some investors may move more capital into Bitcoin or stablecoins.

- Regulation Backlash: Countries, especially powerful ones, may respond with stricter crypto regulations or national digital currency pushes.

- Supply & Demand Shock: If a big holder (real or perceived) dumps, it increases supply. Conversely, if people fear further sales, they may hold tighter, reducing circulating supply.

- Tech & Mining Impacts: Tariffs on hardware, export controls on semiconductors, or energy restrictions could impact mining operations globally.

4. What Should Crypto Investors Watch / Do

- Track on-chain analytics

Tools that monitor large wallet movements, exchange inflows/outflows, and address clusters can offer early warnings of dumps or accumulation. - Hedge or reduce leverage

In volatile times, highly leveraged positions are the first to get wiped. Consider reducing risk or hedging. - Diversify across zones & assets

Holding only BTC isn’t enough. Use stablecoins, alternative protocols, and cross-chain exposure. - Watch macro & policy cues

Pay attention to U.S.–China trade talks, central bank statements, and crypto regulatory changes. - Stay updated with credible sources

Avoid taking viral claims at face value. Always look for official data, on-chain proof, or regulatory statements.

Conclusion

While the claim that “President Xi sold all his crypto holdings” is likely overblown, it stems from real movements in blockchain addresses connected to past seizures. On the other hand, Trump’s threat of a 100% tariff on China is supported by recent announcements and has already rattled markets.

For crypto markets, this kind of geopolitical drama amplifies volatility — potentially wiping out weak hands but also creating opportunity for those who plan carefully. The keys: data, discipline, and staying informed.

If you like, I can turn this into a published article version (with SEO tags, word count, headers) ready to post on your site “Resep Rakyat.” Do you want me to prepare that for you?

Comment